As pandemic-era stimulus programs begin to wind down, interest rates may slowly start to creep back up. The Federal Reserve recently announced that it will start tapering bond purchases later this month. With the dollar becoming scarcer, the cost of borrowing will likely increase in the form of higher interest rates. This means the time is ripe for investors to lock in low interest rates while they last.

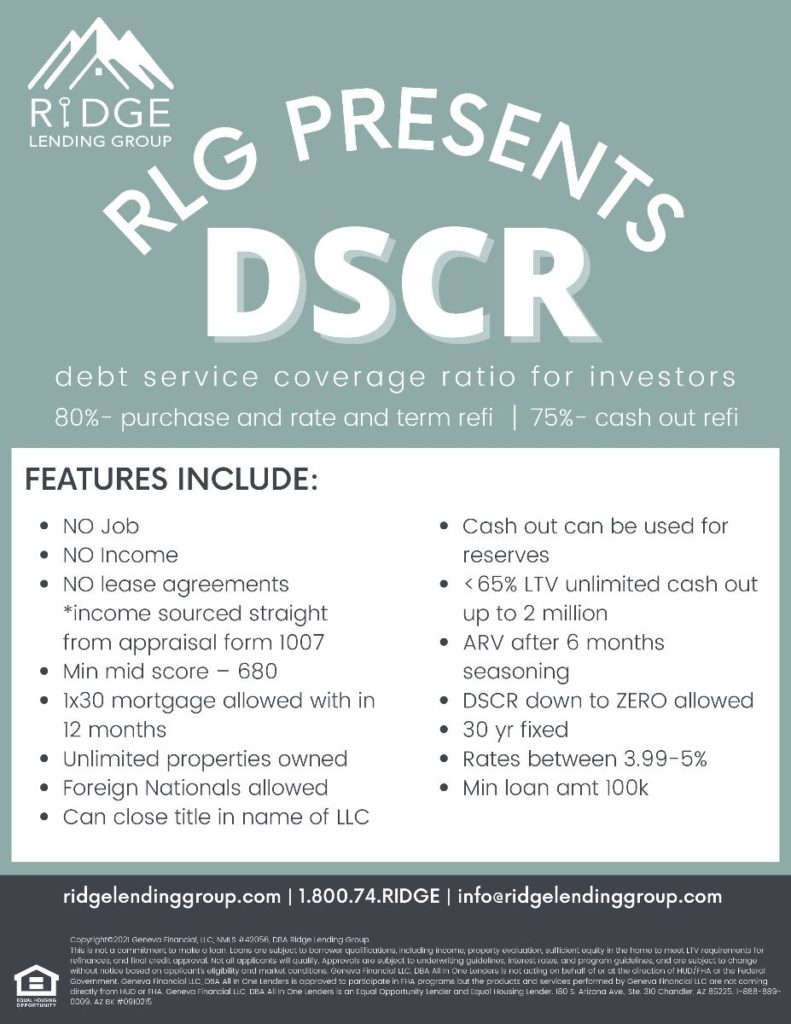

Ridge Lending Group is thrilled to present a new product to real estate investors, the DSCR. “DSCR” stands for Debt Service Coverage Ratio, a term more commonly known in the 5+ unit apartment lending world. Now open to folks in the 1 to 4-unit investment property business, this program takes the focus away from the investors themselves and instead pivots on assets when determining whether someone qualifies for a loan.

In other words, NO job, NO income, and NO lease agreements are required. The income and job essentially come from your tenants. This provides some remarkable flexibility as it allows you to qualify for a virtually unlimited number of properties. Following are some other features of DSCR:

For more information and to start originating new loans or refinance with the DSCR, get in touch with us today!